Fraud Detection

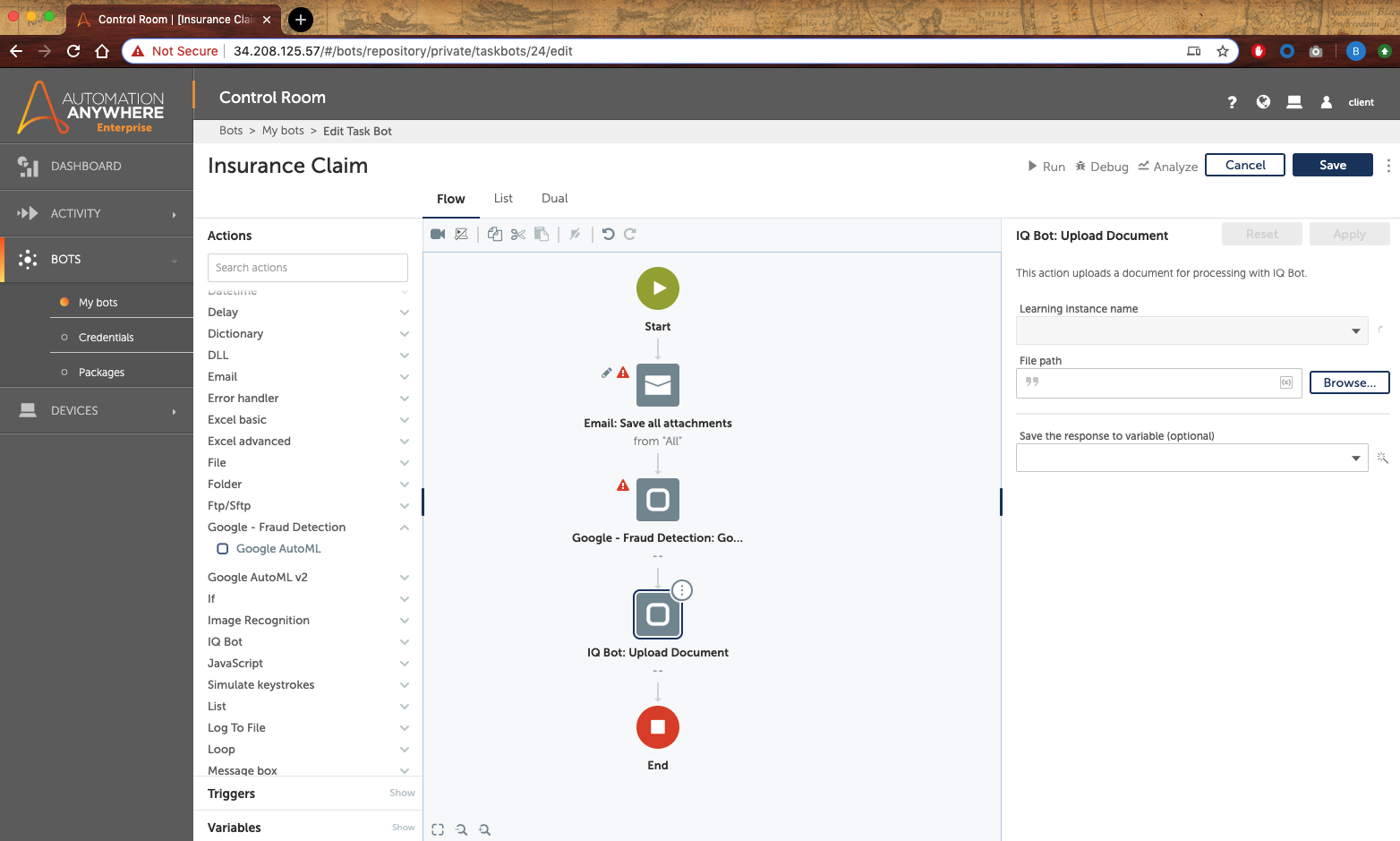

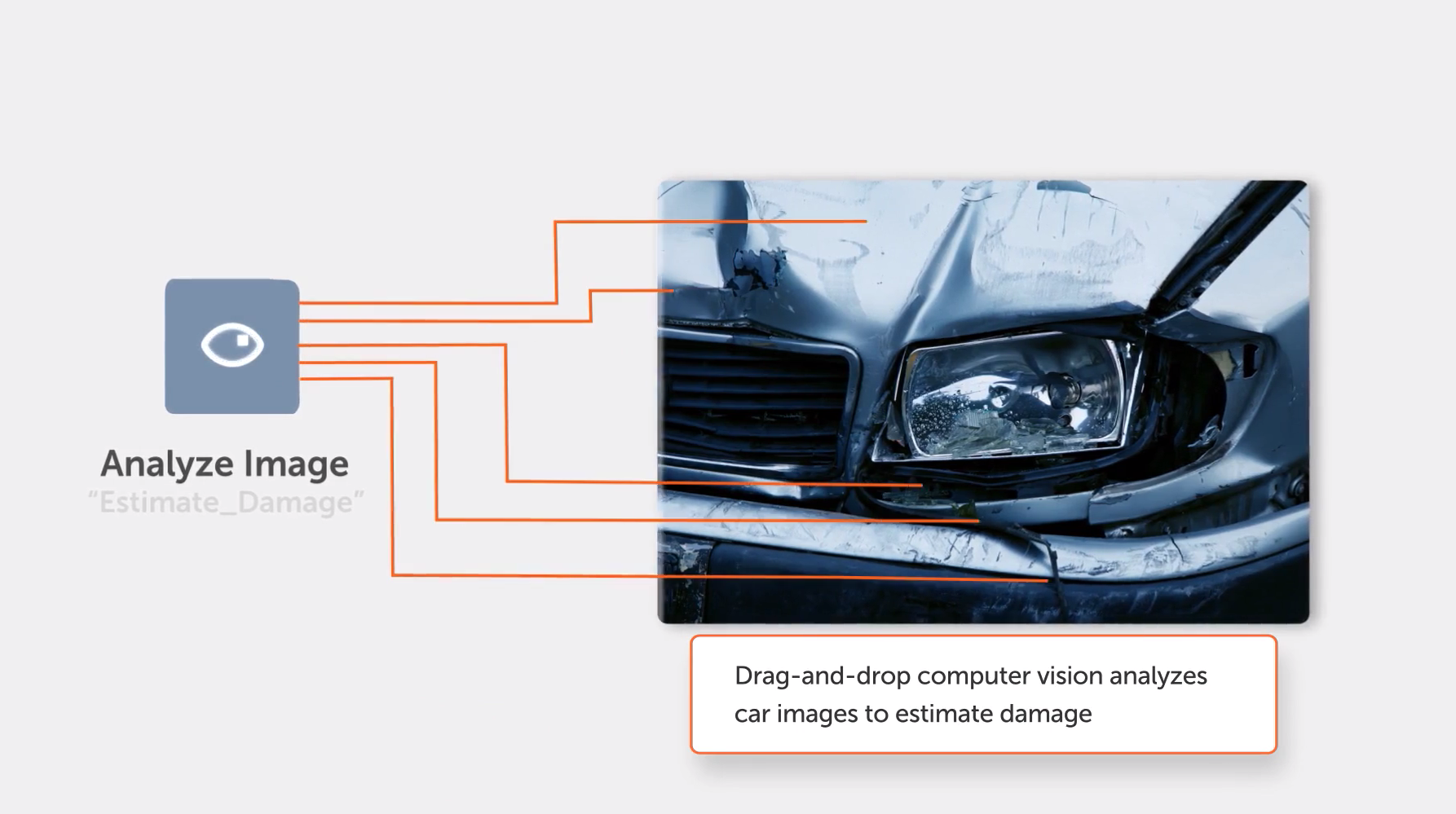

This bot uses Google AutoML image recognition capabilities to detect fraud in context of auto insurance claim processing

Top Benefits

- Industry-leading accuracy for image understanding

- Detect and classify auto images for further downstream automation

- Seamlessly integrates with RPA to use in your bot workflows

- Engaging mobile experience to enables customers upload auto images

Tasks

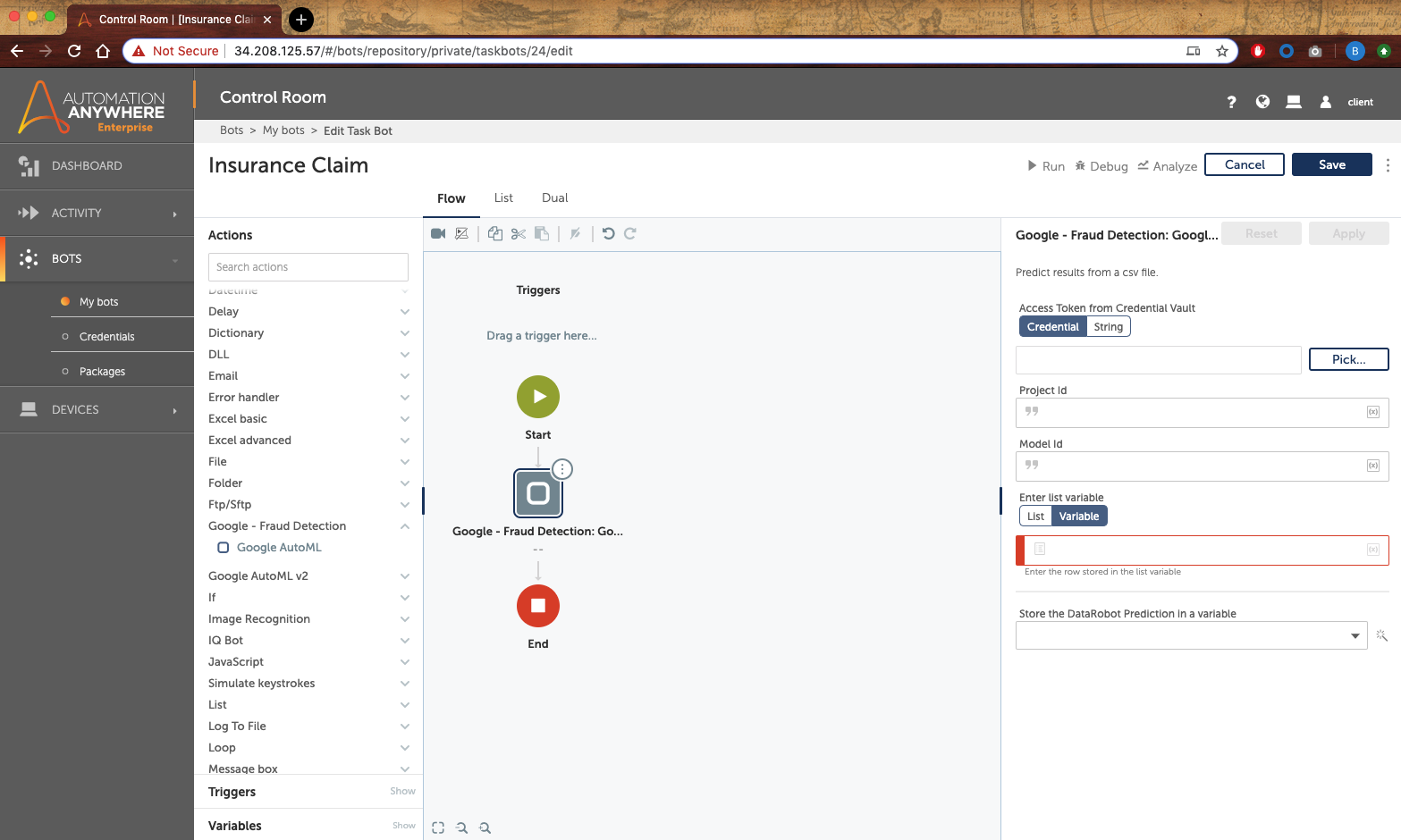

- Input a CSV with details of the policy

- Determine whether that claim represented by policy number is fraudulent or not, and what is the confidence level

Derive insights from your auto images with Google AutoML. Get a pre-trained model to detect and predict fraud.

This model is trained on Google AutoML using labeled fraud detection data in auto insurance claim processing. It predicts if a submitted car accident claim is fraudulent and determines the confidence.

The input is a CSV file with following information: name of the insurer, insurance number, address, date and location of accident. RPA will log into CMS to get more info about the claim and will send it to the Google AutoML package to detect fraud and determines the confidence.

Free

- Applications

-

- Business Process

- Finance & Accounting

- Category

- Artificial Intelligence

- Downloads

- 132

- Vendor

- Automation Type

- Bot

- Last Updated

- May 26, 2021

- First Published

- February 18, 2020

- Platform

- Automation 360

- Support

-

- Community Support Only

- Pathfinder Community Developer Forum

- Agentic App Store FAQs

- Bot Security Program

-

Level 1

Level 1

Setup Process

Install

Download the Bot and follow the instructions to install it in your AAE Control Room.

Configure

Open the Bot to configure your username and other settings the Bot will need (see the Installation Guide or ReadMe for details.)

Run

That's it - now the Bot is ready to get going!

Requirements and Inputs

- Requires a CSV input file with following information - name of the insurer, insurance number, address, date and location

- Requires Google Cloud credentials