Goods and Services Tax (GST) Calculation Bot

Bot allows you to find Applicable GST, pre-GST and post-GST amounts on certain items based on specific GST slabs

Top Benefits

- Accurate results

- Quick and efficient calculation

- Reduces manual efforts

Tasks

- Calculates the amount of applicable GST for certain items

- Calculates Pre/Post GST amounts

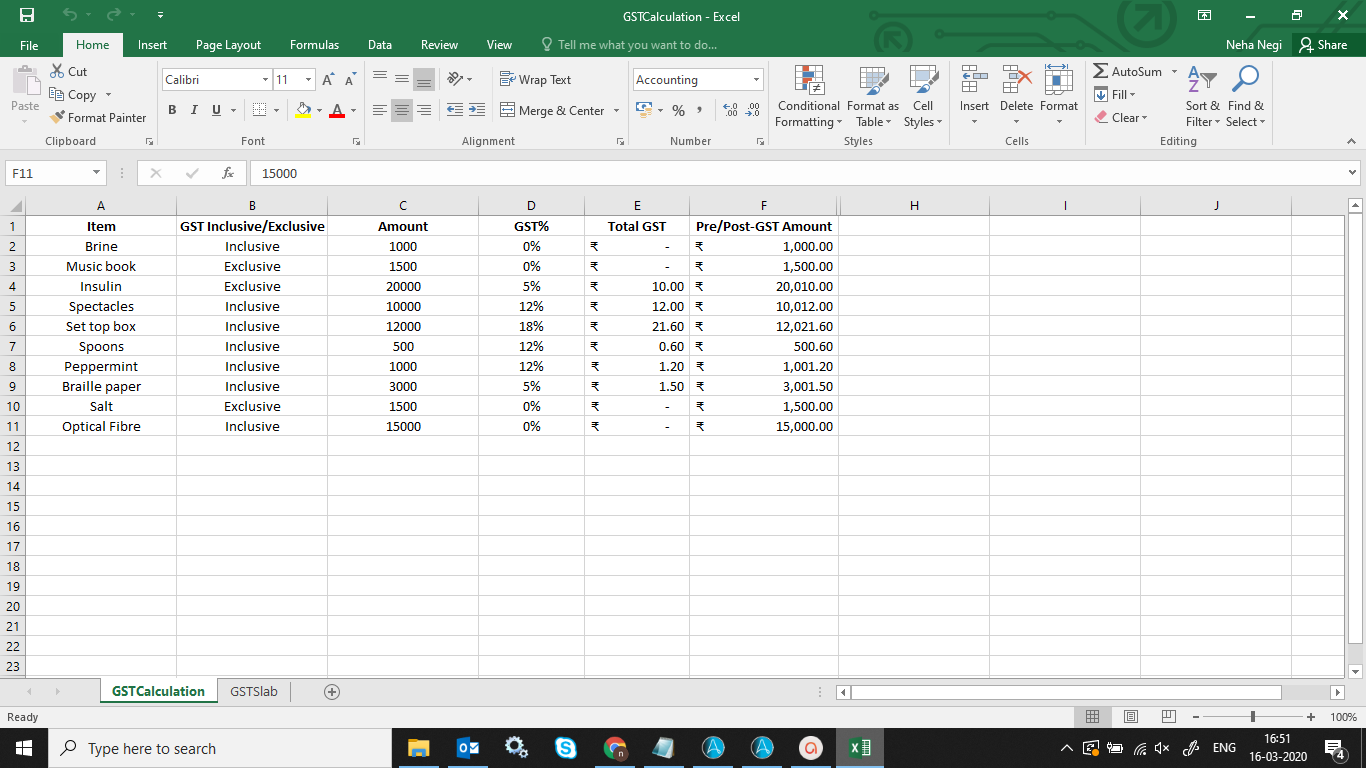

Input: Bot takes an Excel sheet containing the details of the goods such as Item Name, Price, Price inclusive/exclusive of GST.

Action: Applicable amount of GST is calculated using the formula based on inclusion/exclusion of GST.

Output: Calculated amount of GST and total amount inclusive/exclusive of GST is updated in the sheet.

Free

- Applications

-

- Business Process

- Finance & Accounting

- Category

- ProductivityUtility

- Downloads

- 24

- Vendor

- Automation Type

- Bot

- Last Updated

- December 11, 2020

- First Published

- March 19, 2020

- Platform

- 11.x

- ReadMe

- ReadMe

- Support

-

- In2IT Technologies

- Mon, Tue, Wed, Thu, Fri 9:00-17:00 UTC+0

- 911204842600

- info@in2ittech.com

- Agentic App Store FAQs

- Bot Security Program

-

Level 1

Level 1

Setup Process

Install

Download the Bot and follow the instructions to install it in your AAE Control Room.

Configure

Open the Bot to configure your username and other settings the Bot will need (see the Installation Guide or ReadMe for details.)

Run

That's it - now the Bot is ready to get going!

Requirements and Inputs

- Input file containing the data of items including the item type, price, price inclusive/exclusive of GST

- GST slabs file containing the details of GST% applicable for different items