Read IRS Form 1099 for SBA Paycheck Protection Program (PPP)

Accelerate the Paycheck Protection Program (PPP) loan submission and validation process by automating reading of IRS Form 1099.

This bot is included with purchase of PPP Loan Submission in SBA E-Tran System bot.

Top Benefits

- Speeds loan submission process

- Improves accuracy by eliminating manual input

- Frees up lender resources to focus on other activities

Tasks

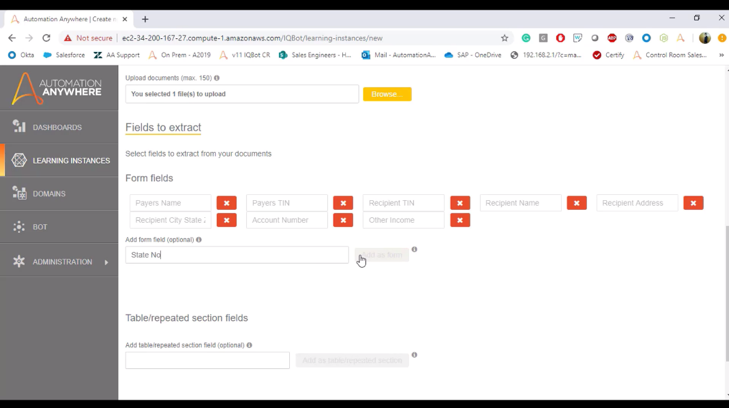

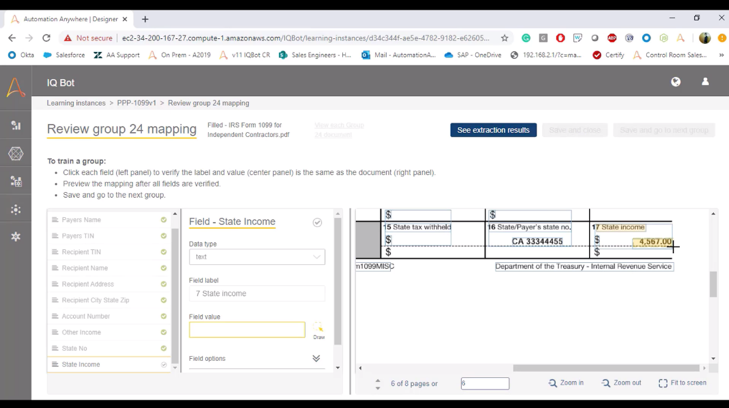

- Reads IRS form 1099 using IQ Bot

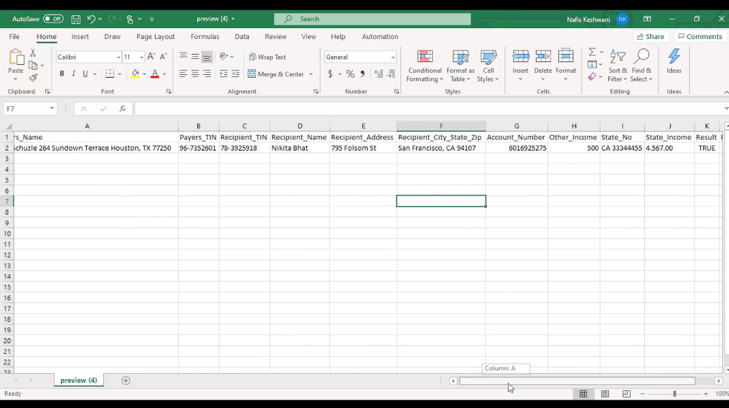

- Inputs read data into Excel

If you are an SBA lender, you have likely received thousands of applications for Paycheck Protection Program loans under the CARES Act. This bot is your ally in reducing the backlog of loan applications by automating the reading of 1099 - Miscellaneous Income forms quickly and accurately.

This bot is included with purchase of PPP Loan Submission in SBA E-Tran System bot.

Free

- Applications

-

- Business Process

- Finance & Accounting

- Category

- Banking and Financial Services

- Vendor

- Automation Type

- Bot

- Last Updated

- July 1, 2024

- First Published

- April 15, 2020

- Platform

- 11.3.3.1

- Support

-

- Community Support Only

- Pathfinder Community Developer Forum

- Agentic App Store FAQs

Setup Process

Install

Download the Bot and follow the instructions to install it in your AAE Control Room.

Configure

Open the Bot to configure your username and other settings the Bot will need (see the Installation Guide or ReadMe for details.)

Run

That's it - now the Bot is ready to get going!

Requirements and Inputs

- IQ Bot

- Microsoft Excel