Validate European VAT Code

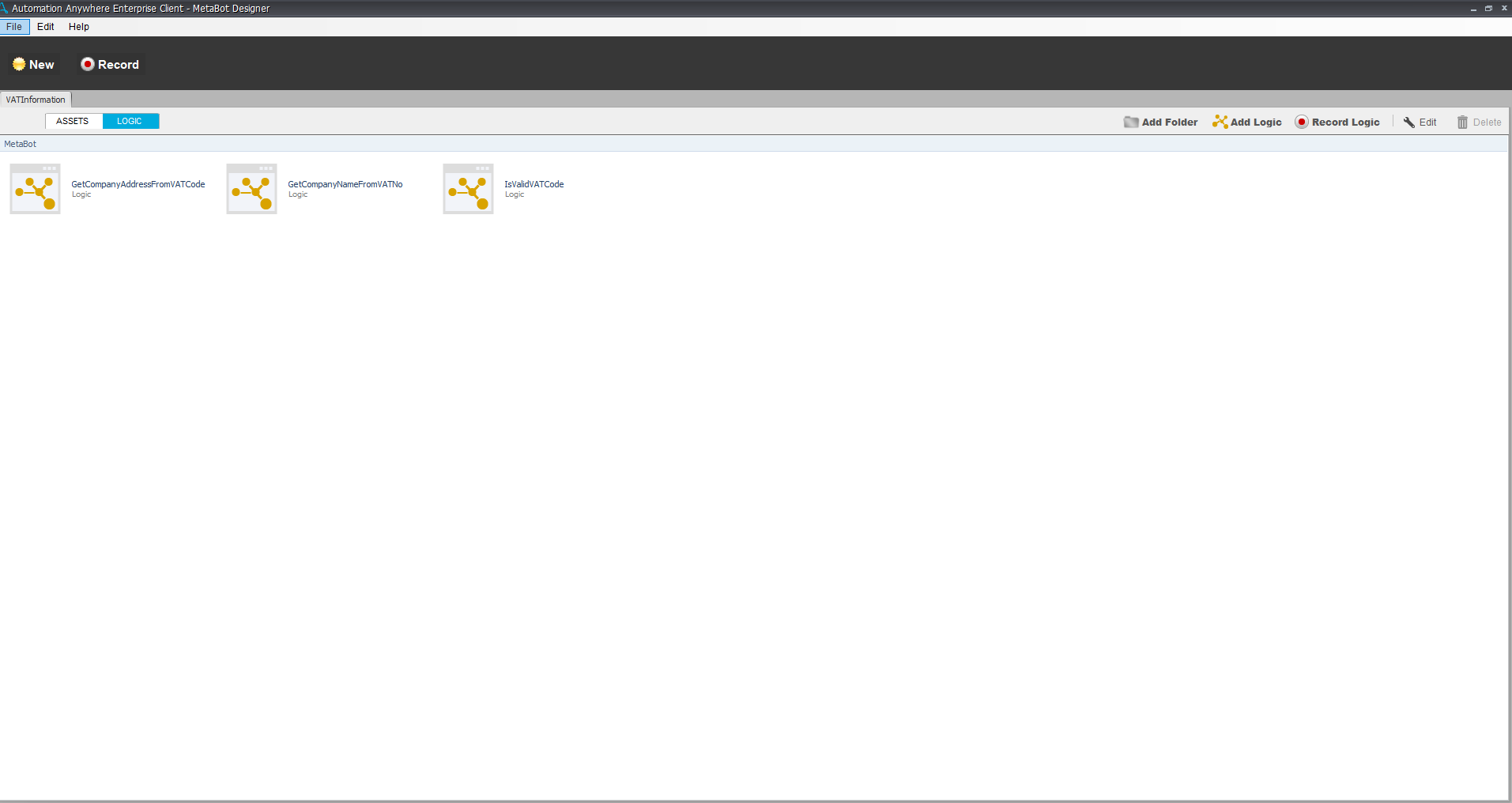

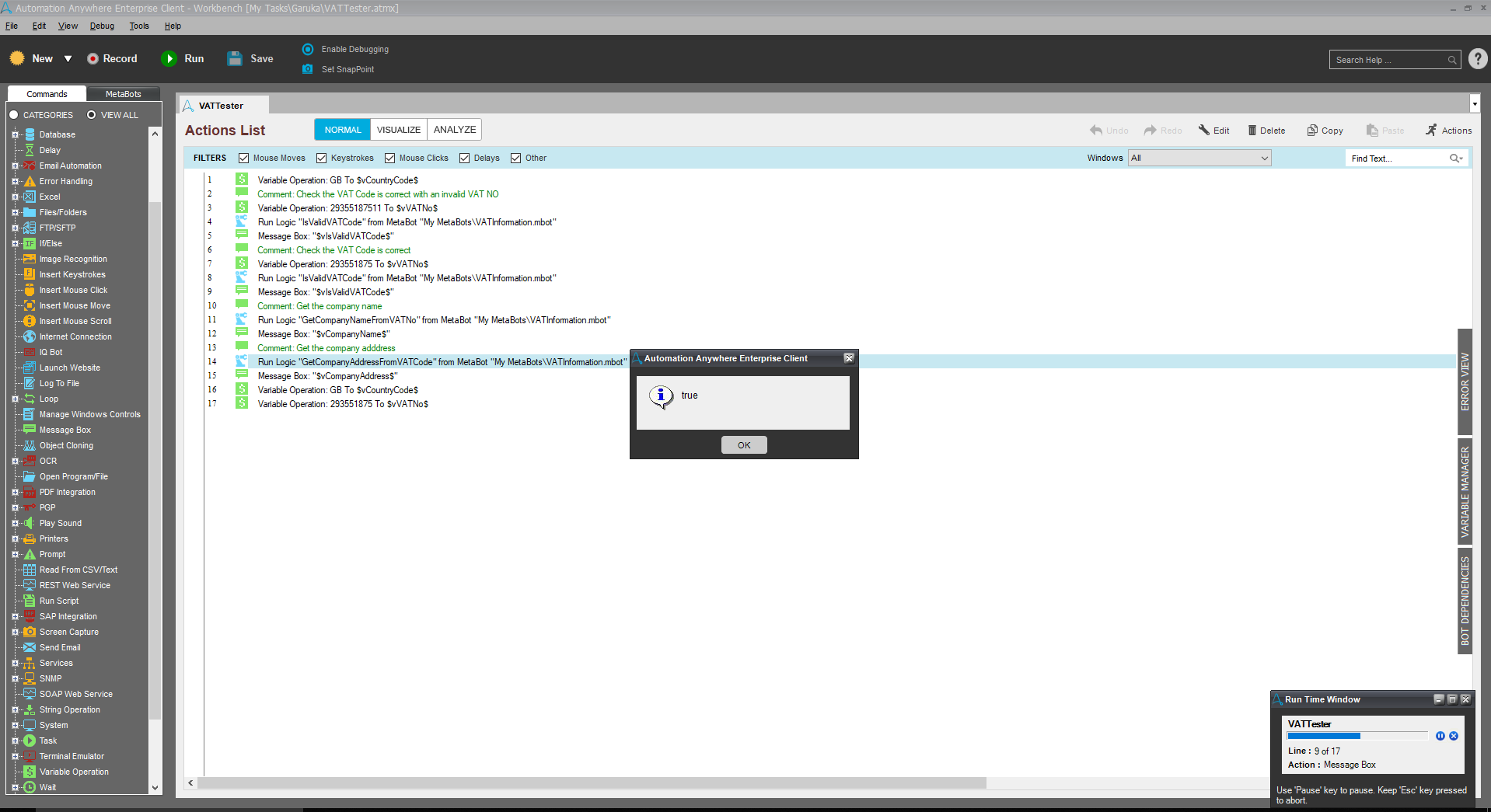

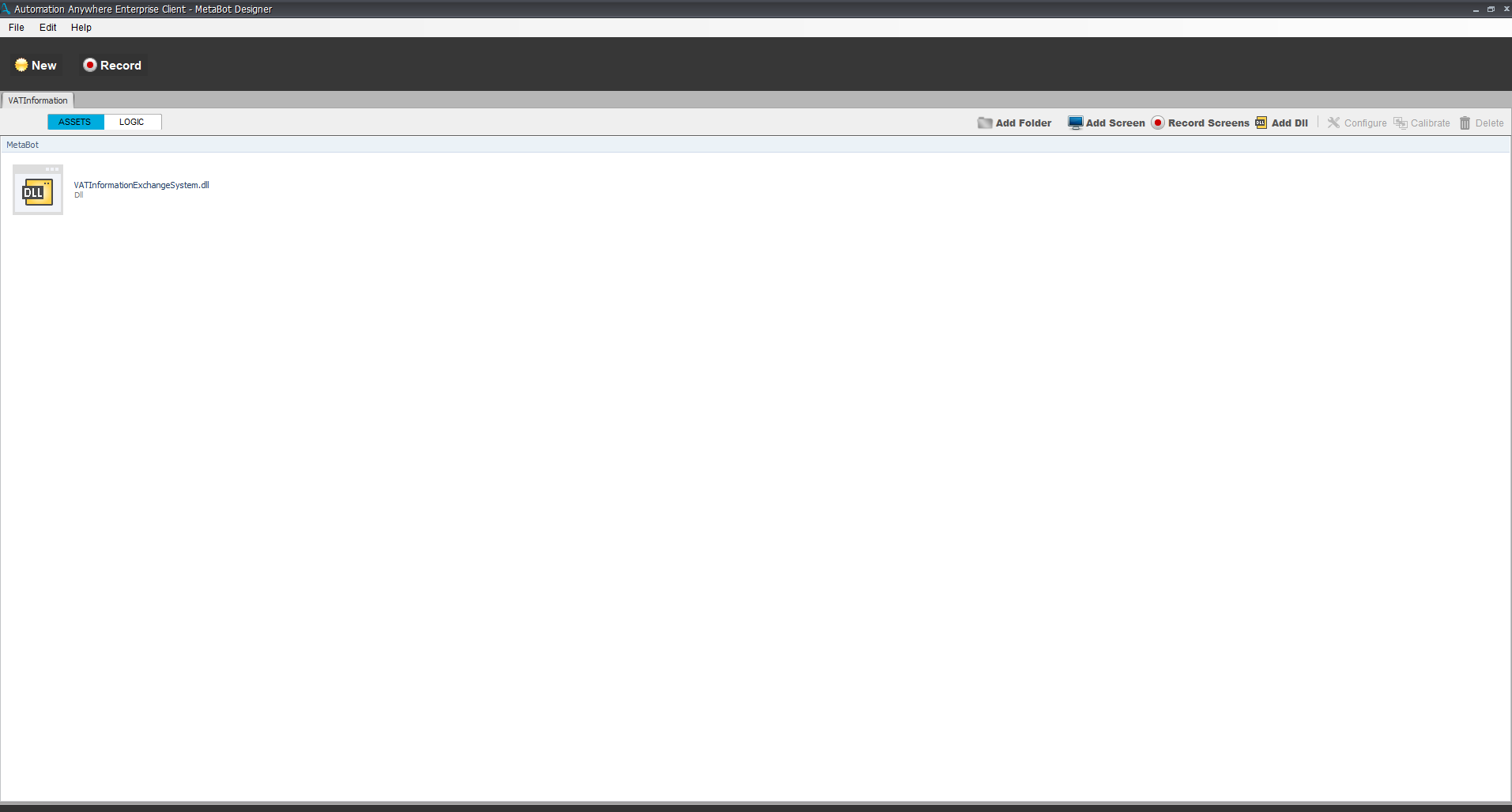

This metabot allows you to validate any European VAT code and get the company name and registered address. Information will be validated against European Commission’s VAT Information Exchange System.

Top Benefits

This Metabot allows you to validate any European VAT code and get the company name and registered address. Information will be validated against European Commission’s VAT Information Exchange System.

Inputs for this Metabot takes a country code and a VAT (Value-Added Tax) code, and returns the outputs are:

1. Whether or not the VAT code is valid

2. If valid, then the registered company for VAT Code

3. Registered address for VAT Code

Key Use Case: Vendor/Customer changes When creating new clients or vendors, VAT validation can be done using attached metabot.Vendor/Customer changes

When creating new clients or vendors, VAT validation can be done using attached metabot.

Free

- Applications

-

- Business Process

- Finance & Accounting

- Category

- Utility

- Downloads

- 93

- Vendor

- Automation Type

- Bot

- Last Updated

- December 21, 2020

- First Published

- April 15, 2019

- Platform

- 11.3

- Support

- Bot Security Program

-

Level 1

Level 1

Setup Process

Install

Download the Bot and follow the instructions to install it in your AAE Control Room.

Configure

Open the Bot to configure your username and other settings the Bot will need (see the Installation Guide or ReadMe for details.)

Run

That's it - now the Bot is ready to get going!

Requirements and Inputs

- '- AAE 11.3- .Net runtime 4.5+ - Internet access

- Inputs: Please refer the readme file